Retirement Isn’t A Solo Journey – So Go Beyond A Solo Advisor.

Surround yourself with an in-house team of specialists in every area that matters: planning, investing, taxes, retirement, estate, and beyond.

We’ll create a plan and proactively manage every aspect of your finances, retirement and taxes. You go live your best life.

Get a dedicated team built for you that consists of a Wealth Manager, Tax Professional, Investment Team member & Client Relationship Manager.

Hey there Mark

We got your IRA & Trust Accounts invested – monthly income starts on Monday. Enjoy your fishing trip!

This isn’t automation, it’s personalization.

Hey Mark, we just made some investment trades to reduce your taxes.

I saw the trade notifications! How much will it save me?

I saw the trade notifications! How much will it save me?

It looks to be around $3,000 in taxes! See you at our next face-to-face meeting!

Hi Maggie!

We finished your taxes and filed them with the IRS! Your Fed refund of $5,227 will be auto-deposited by end of the month.

In between face-to-face meetings, zoom or phone calls, we are always with you. We’re only a click away.

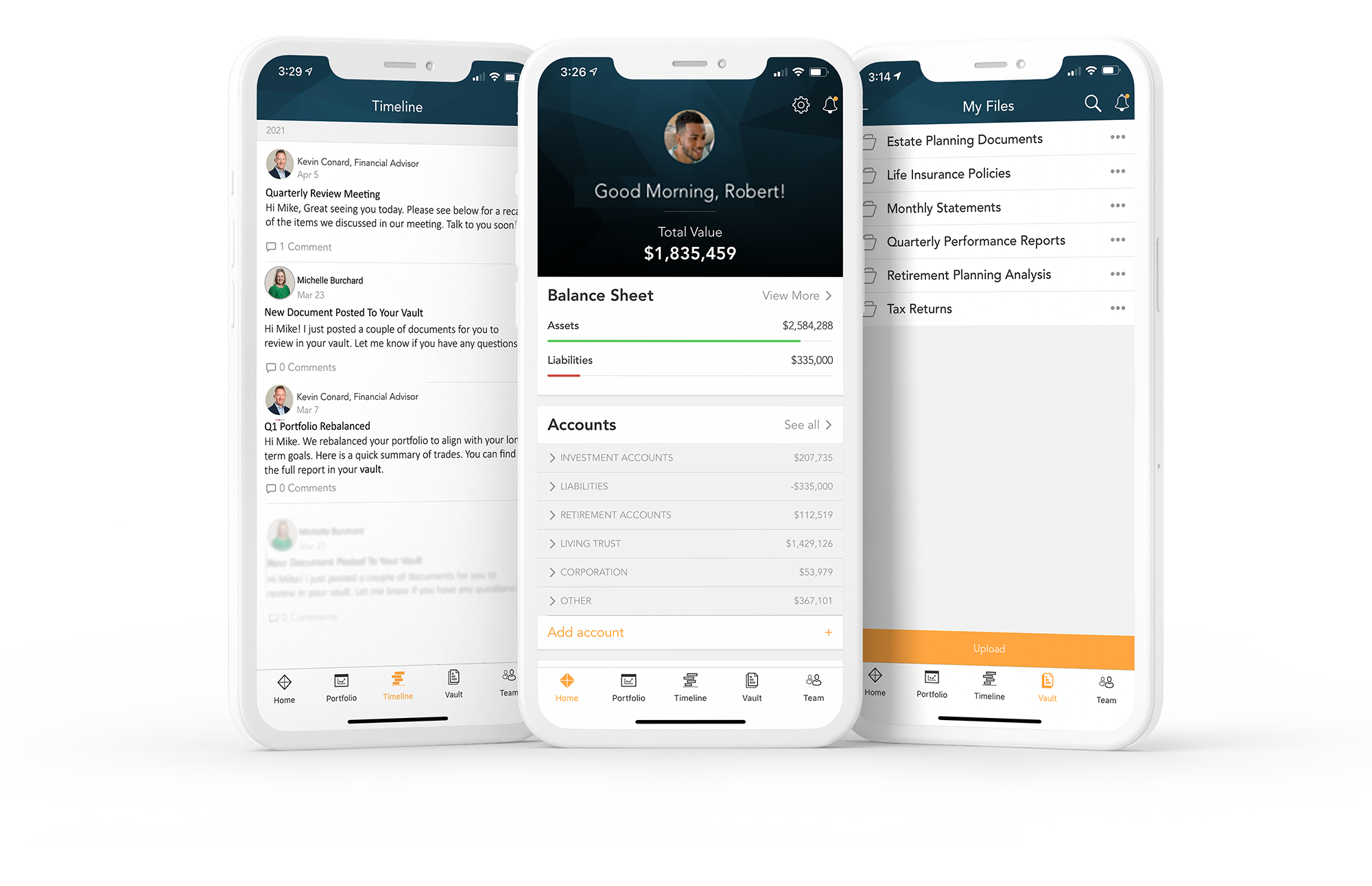

Our app will show you progress, past activity, transactions, conversations and reports in your Timeline and Vault! We keep track to make sure you are on track.

Evening Jarred

We finished your Social Security analysis and posted it in your online Vault – age 67 is probably the optimal time for you to file for benefits!

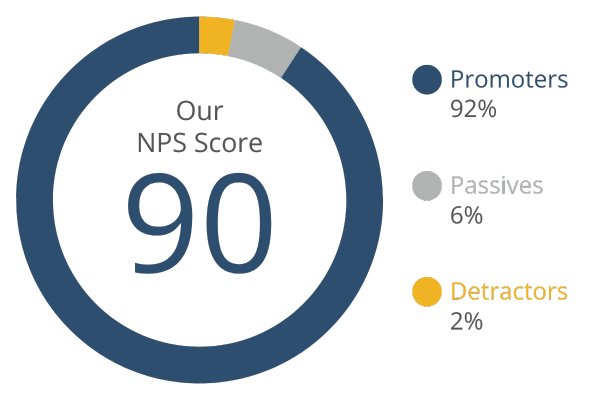

Clients give us a higher recommendation score than companies like Apple®.

Net Promoter Score is the percentage of clients rating their likelihood to recommend a company, a product, or a service, to a friend or colleague. The average score in the Financial Services sector is 44. Our average score is 90 (from 10/27/2017 to 1/1/2025). The Retirement Planning Group does not control client responses. Twice a year clients are provided the opportunity to share the likelihood they’d refer a client to us by providing a score between 1 and 10 (10 being the most likely to refer). “Promoters” are the percentage of clients that selected a score of 9 or 10. “Passives” are the percentage of clients that selected a score of 7 or 8. “Detractors” are the percentage of clients that selected a score of 1 to 6.

Heads-up Sarah

We set up the 529 College Savings account for your grandson and got it invested!

Trusted By People Like You

We take pride in delivering exceptional service. Here's what some of our clients have to say about their experience.

![]()

07/16/2024

"The many years of association has built trust and I truly feel that my personal interests are well cared for. I know the caliber of people that I deal with in the group as well as my advisor. There may be some better out there, but you would have a hard time convincing me of that."

![]()

05/07/2024

"I've been a client of theirs since 2007. The whole staff is very personable and knowledgeable. I feel my money is well taken care of. I recommend them to my friends and family."

![]()

07/09/2024

"We chose TRPG because of the great service. Understanding our needs & listening to our opinions & concerns."

![]()

08/26/2025

"Always helpful. Explains to me any questions I have. Keep me informed of anything that is changing or that I might be interested in. Ask me questions that gets me thinking about possible changes coming up."

![]()

09/24/2024

"Great people who care about you individually and help you meet your dreams!"

![]()

01/22/2024

"The Retirement Planning Group continues to keep our best interests at the forefront. They maintain a great level of communication as to their actions and constantly look for growth opportunities."

![]()

09/19/2024

"My advisor has always gone above and beyond. He is always easy to get in contact with and takes care of any issues. He will contact me regularly to see how things are going and if I need anything. More than happy with him and everyone I’ve dealt with at the business."

![]()

07/12/2024

"Everyone in the organization is there to serve the clients! With expertise, extensive applicable knowledge, and excellent people skills, this group performs! Results speak for themselves."

![]()

03/19/2024

"Everyone at TRPG is friendly and efficient. My questions are answered promptly and in a way that I can understand the sometimes complex financial issues."

![]()

04/23/2024

"Great service. That is what it is all about. Easy to get appointment to sit down with advisor and always helpful. 100% recommend."

![]()

07/09/2024

"We really like and trust our advisor and the firm. Very thorough, committed to great customer service, while also committed to giving you the best results possible."

Reviews are voluntary and provided by current clients. Clients have not been paid, nor do they receive any other compensation for making these statements. As a result, there is no conflict of interest to report as the client does not receive any material incentives or benefits for providing the testimonial.